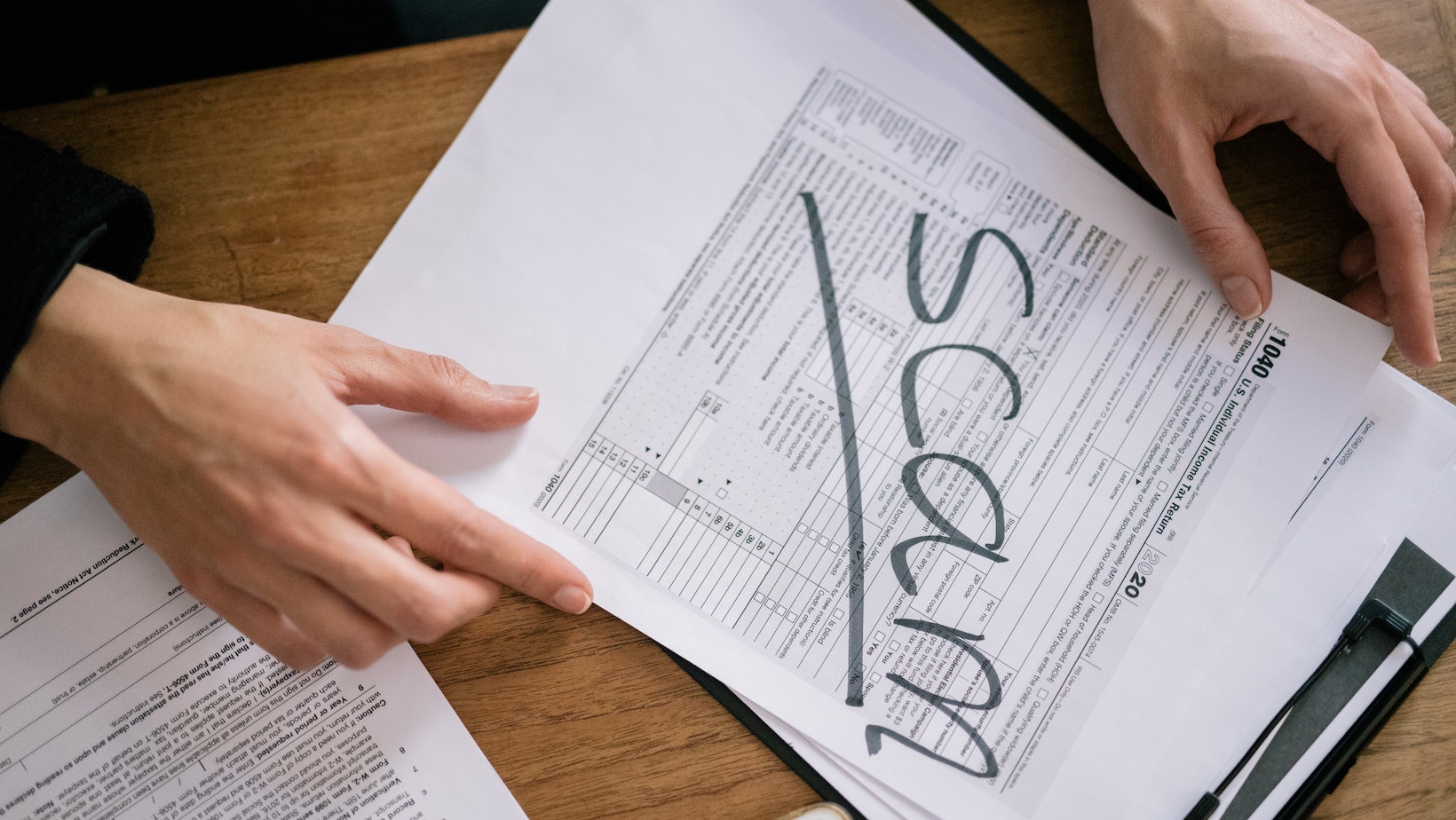

When it comes to scams and fraud, it can be challenging to distinguish between legitimate transactions and deceptive schemes. In today’s digital age, where cybercriminals are becoming increasingly sophisticated, it’s crucial to be aware of the various tactics they employ to deceive unsuspecting victims. But how does one determine if someone has willingly authorized a scam or fraud? Let’s delve into some examples that shed light on this perplexing question.

One common example is the “phishing” technique used by scammers through email or text messages. They often pose as trusted entities like banks or government agencies, tricking individuals into sharing sensitive information such as passwords or financial details. While victims may unknowingly provide this information, it’s important to note that authorization in these cases is not intentional but rather a result of manipulation.

Another scenario involves fraudulent investment schemes promising high returns with minimal risk. Victims may voluntarily invest their money based on false promises and misleading information provided by the fraudsters. However, it’s crucial to understand that these individuals have been misled and do not genuinely authorize the scam but rather fall victim to clever persuasion tactics.

In conclusion, falling into the trap of authorizing a scam or fraud can happen due to manipulation and deception employed by cunning criminals. It is vital for individuals to stay vigilant, educate themselves about common scams, and exercise caution when sharing personal information or investing their hard-earned money. By doing so, we can protect ourselves from becoming victims of these fraudulent activities.

Which Example Shows A Victim Authorizing A Scam Or Fraud?

When it comes to protecting ourselves from scams and frauds, knowledge is power. By familiarizing yourself with the signs, you can avoid falling into the trap and becoming a victim. In this section, I’ll outline some key indicators that can help you recognize potential scams or frauds.

- Unsolicited Contact: Be wary of unsolicited phone calls, emails, or text messages claiming to be from reputable organizations or individuals. Scammers often pose as banks, government agencies, or even friends in order to gain your trust and deceive you.

- Pressure Tactics: Scammers will often use high-pressure tactics to push you into making hasty decisions without thinking them through. They may create a sense of urgency by claiming that there’s limited time for an offer or that dire consequences will occur if you don’t act immediately.

- Requests for Personal Information: Legitimate organizations rarely ask for sensitive personal information such as Social Security numbers, bank account details, or passwords via email or phone calls. If someone asks for this information without a valid reason, it could be a red flag.

- Too Good to Be True Offers: If an opportunity seems too good to be true, it probably is! Scammers lure victims with promises of instant wealth, easy money-making schemes, or unrealistic returns on investments. Remember: legitimate opportunities require effort and come with realistic expectations.

- Poor Grammar and Spelling Mistakes: Many scam emails originate from non-native English speakers who often make grammar and spelling mistakes in their attempts to deceive recipients. Pay attention to these errors as they can indicate fraudulent activity.

- Payment Requests via Untraceable Methods: Scammers prefer untraceable payment methods such as wire transfers or gift cards because they provide little recourse for victims seeking refunds or assistance in case of fraud.

- Lack of Verifiable Information: Legitimate businesses have a clear online presence, contact information, and customer analysis. If you can’t find any evidence of a company’s existence or their claims seem unsubstantiated, exercise caution.

Remember, scammers are constantly evolving their tactics, so it’s important to stay vigilant and trust your instincts. If something feels off or too good to be true, take a step back and do some research before proceeding. By recognizing the signs of scams and frauds, you can protect yourself from becoming a victim.

It’s important to be vigilant and aware of these common methods used by scammers. Remember, if something seems too good to be true or feels suspicious, it’s crucial to verify the legitimacy before taking any action. By staying informed and cautious, we can protect ourselves from falling into the trap of scams or frauds.